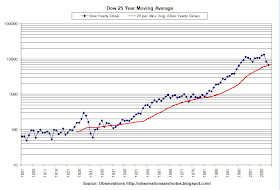

Dow 25-Year Moving Average Graph

Dow 25-Year Moving Average

Note: click on the graph to enlarge it. For a more updated version of the above graph, see 2010 End-of Year Stock Market Update. 100 Years of Stock Market History for the latest 100-year chart w/o moving average.A Critical Area on the Dow?

To my knowledge, this is not a widely followed metric. In the history of the Dow, I see only four previous periods when we have been in this area:

- The Great Depression -- the 1932 & 1937 troughs in the graph (For more on this period in stock market history, see 1929-32 Crash Revisited)

- World War II -- the 1940-43 trough

- The Vietnam War/ Oil Crisis years culminating in the 1974 trough

- The high inflation era culminating in the 1981 trough

Stay tuned.

Update

Note: the Dow bottomed 5 days later on March 9, 2009 at 6547.

The moving average closed out 2009 at 6559.Related Posts

See this post for the most recent update to the 25-year moving average text, not graph.100 Years of Stock Market History for the latest 100-year chart w/o moving average.

For lists of popular posts and an index of all stock market posts, by subject area, see the sidebar or the menu bar in the blog header.

Last modified 1/4/2013

We've already had as big of a crash as 1929-1930. The scary thing is will 1931 happen again....prices dropped 70% for a total loss of 85%...we'd be looking at a DJIA of 2100. The good news is even then most of the loss was regained in 2 or 3 years

ReplyDeleteAnon makes an important point -- so important that I think it deserves a separate post.

ReplyDeleteComing soon....

Anon,

ReplyDeleteIf you measure from the 1929 peak to the 1932 trough, the loss is even greater. See http://observationsandnotes.blogspot.com/2009/03/1929-1932-stock-market-crash-revisited.html

BABY BOOMER'S ARE RETIRING!!! RUN FOR THE HILLS!!! This last crash was a wake up call warning them that its time to cash in savings for those rainy days...Most of them were brought up by post-depression fathers and mothers...

ReplyDeleteNeed I say....nice job calling the bottom!

ReplyDeleteI'd like to take the credit, but, truth is, I don't really call bottoms -- or tops. My intent was just to provide some history and perspective. The market has rarely gone below the 25-year moving average. That doesn't mean it can't. Elsewhere on the site you will find analysis that suggests other possible bottoms; those weren't calls either.

ReplyDeleteThanks for stopping by the site.

Regarding boomers, nice try there with the fear selling. Demographic shifts dont really have the power to create market ups and downs. Population shifts take a while and are known. Stocks dont usually price in changes that happen slowly over 20 to 30 yrs. Some boomers will sell stocks, but many will buy more stocks and they build wealth over the coming decades. They may pass wealth on to others who spend and invest. This helps the economy. THey can sell their businesses upon retirement and then invest more. This isnt a zero sum game. Capital markets grow and expand. Dont buy in to messages based on fear. Fear always sells. Be smart.

ReplyDelete