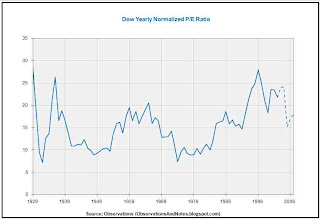

Yearly Graph of Dow Price Earnings (P/E) Ratios Since 1929

The chart above (click to enlarge), goes all the way back to 1929; it ends at year-end 2019. What's most striking about this graph is the variability of the price/earnings ratio; the p/e ratio is the price you have to pay for $1 of earnings. This earnings multiple varies from close to 30 all the way down to around seven. And, remember, these are normalized price earnings ratios (the price divided by normalized earnings -- NE). I call this the NPE. If I had used the standard yearly p/e ratio, the variation would be even more dramatic. (As you might guess from just looking at the chart, the average normalized price/earnings ratio is about 15. For more on the normalization calculation, see the end of the post.)

The other thing you might notice is the years in which the big decreases and increases in NPE occurred. Notice anything? The big drops in earnings multiples, or valuation, correspond to years when the stock market crashed -- 1929 for example. The long periods of increases just happen to correspond to years where there was a tremendous bull market -- 1994-1999 for example.

The Impact of Price/Earnings (P/E) Ratios on Dow Performance and Returns

Dow Performance vs P/E History

The above chart (click to enlarge) shows the same NPE data combined now with a) normalized earnings, b) dividends, and c) the Dow year-end closing price. The vertical axis for NPE values has been moved to the right-hand side. The vertical axis for the other data is on the left-hand side. (The left vertical axis is log scale; for a short discussion of log graphs, see About Stock Market Log Graphs.)This chart reinforces what you might have guessed from looking at the first chart. Notice how (relatively) smooth the growth is in the normalized earnings and dividends lines. There is a pretty consistent up-trend -- around 6%/year. And, I think of those as the underlying trends supporting the Dow closing prices. However, the graph of Dow closing prices is not nearly as consistent. Where do we see the big drops in the Dow? When there are big drops in the earnings multiple -- NPE. Where do we see the Dow in long bull markets? When the NPE increases.

What Really Drives Stock Market Prices?

All of the above is based on DJIA (Dow Jones Industrial Average) data; we'd see essentially the same pattern if we were looking at S&P 500 data. Bottom line: In my view, stock market value is driven primarily by earnings and dividends. However, based on about 100 years of stock market history, it looks like year-to-year stock market prices are driven by the earnings multiples -- i.e. p/e ratios. As I have said before, and no doubt will say again, ignoring valuation may be hazardous to your (financial) health.

For an even clearer view of the impact of p/e valuation on (short-term) returns, see The Extraordinary Impact of Price to Earnings Ratios.

Note re normalized earnings (NE)

The normalized earnings for any year are the average of that year's earnings with the 5 previous and 5 following years' earnings. For a more detailed discussion, see About Normalized Earnings and P/E Ratios.

Because of the way I normalize, some of the data needed to calculate normalized earnings and the normalized p/e for 2015-2019 are not yet available. The dashed lines at the end of those two series represent estimated values. I've extrapolated earnings based upon their historical growth rate of a little less than 6%, and computed the normalized p/e based upon those earnings.

Related posts

"Components of 10-Year Returns" shows the contribution of p/e ratio to 10-year returns.Starting P/E Ratio vs 10-Year Returns The impact of initial P/E on subsequent returns.

Dow Price/Dividend Ratio & Dividend Yield History Graph: another important way to look at valuation.

Dow Price/Earnings Ratio Impact on Future Returns - A Summary Returns of purchases made when p/e ratio is high compared to returns on low p/e purchases.

P/E Ratios vs Rolling Returns: another look at relationship between p/e ratio and future returns.

10-Year Forecasting Methodology: using this historical data to predict future returns.

Worst-Case Scenarios Based on 100 Years of Dow Price/Earnings History

For lists of other posts, by category, see the drop down list (mobile viewers) or tabs (computer viewers) just below the blog header at the top of the page. There are additional links in the sidebar if your device supports sidebars.

Share This Article

To share via Facebook, Twitter, Pinterest, etc., see below except on mobile devices (where you share in the normal way).Copyright © 2009. Last modified 10/3/2020

Archives

can i find historical data of P/E ratio of DJIA

ReplyDeletewith XL format not Graph

please help me it's urgent

Anon,

ReplyDeleteSee the "Stock Market Analysis Model" section of "Stock Markets Spreadsheet and Data Navigation Guide" in the sidebar. Or, for example, see the "Analyzing and Understanding 100 Years of Stock Market HIstory" post. Both have links to my Stock Market Analysis Model. The model is an Excel spreadsheet that has Dow prices and earnings starting around 1929. It already contains my NORMALIZED p/e ratio. If you want regular p/e, you can add a column for that as well.

Good luck.

Al

It's in the Stock Market Analysis Model linked to at the end of various posts including

ReplyDeleteStock Market Yearly Returns Since 1929

What we need is a graph that shows the comparison of p/e ratios to 10 treasury yields. Looking at p/e in isolation does seem very helpful to me.

ReplyDeleteI will take that under consideration. Meanwhile, if you're interested, you can do the comparison yourself by combining my stock market analysis model data (see subject index in the sidebar) with the GS10 interest rate data linked to from the interest rate posts.

ReplyDeleteYou may be underestimating the value of normalized p/e. It's one of the most effective predictors of long-term returns; see, for example, Projecting Stock Market Returns. Unfortunately, it's not a very good predictor of short-term results.