Counting on Average Market Returns May be Hazardous to Your Health

Does your retirement plan assume you will earn average returns on your stock market investments? Are you assuming that because over the long run market returns don't seem to vary much from the average you are safe counting on average returns? If you assume average returns, you are going to be disappointed much of the time -- possibly dangerously disappointed. The average is a good place to start your analysis. However, in this post I hope to convince you that it's not a good place to stop.In a post in May, we saw that for a theoretical buy and hold investor, the longer the holding period the closer the annual return converged on the long-term average stock market return of around 10% per year. However, in a recent post we saw that while the annualized percentage returns converge with time, stock market dollar returns diverge with time. In this post we'll take a first look at the impact this has on retirement planning.

Retirement Savings Assuming "Average" Returns

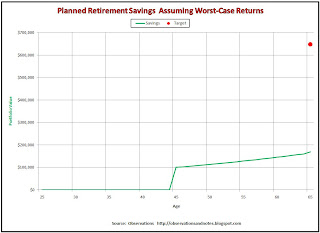

In the above graph (click to expand), we assume that you are a 45 year-old planning to retire at age 65, but somehow you haven't gotten around to saving anything yet. You've played around with a handy dandy simple retirement planner such as the retirement spreadsheet I introduced in October, and determined that "your number" is $673,000. That is, given your expected pension and social security income, on your retirement date you will need a $673,000 investment portfolio to supplement your guaranteed income. Further, assume that you have just inherited $100,000 from your rich uncle (you weren't one of his favorites....). It turns out that the average 20-year return of the Dow has been about 10%, and $100,000 at 10% for 20 years just happens to be about $673,000.

So, you're home free. Well, on average you are. (Note: for this analysis we're going to ignore realities such as tax law and management fees.)

Retirement Savings Assuming Worst-Case Returns

However, if in the next 20 years you experience the returns that investors experienced between 1928 and 1948 (2.5%/year), at retirement you will have $164,000 instead of the planned $673,000 -- as shown in the graph above (click to expand). That's approximately 25% of what you plan; you would be about half a million dollars short. Depending on how important your retirement portfolio is to your total income, this could be devastating.

Averages are helpful because they summarize a large amount of data and make it more manageable. In this case, however, I think the average hides some very valuable information. In particular, it hides the impact of the below average cases. An important part of retirement planning is managing risk. My guess is that few retirees would be content with a plan that said, in effect, with your current assets and strategy you'll be fine -- "most of the time."

Critique

It's easy to take exception to this analysis. For example, I've assumed you invest your inheritance 100% in the stock market -- not something I would normally recommend. In addition, though the average 20-year stock market return has been about 10%, it's probably not a realistic assumption for investor returns -- published stock market returns ignore things like commissions, taxes and management fees. The point is, whatever percent of your retirement savings is invested in the stock market, you need to evaluate the risk and impact of below average stock market returns; the impact can range from inconsequential to devastating, depending on factors such as the role the stock market portfolio plays in your overall retirement plan, years to retirement, etc.Look at the Likelihood

A different investor in a different time (1979-99) would have experienced the best returns in our database. In that case, he would have retired with over $2.7 million! When calculating averages, the above average return periods offset the below average return periods. However, retirement investors experiencing below average return periods are not likely to be consoled by the fact that somebody else's good fortune is making up for their misfortune.Should you, therefore, assume the worst case in your retirement planning? I think not. However, I do think it's critical that you not blindly assume that you will experience average returns. Since the range of possible outcomes is so wide, it is instructive to look at the likelihood of selected outcomes between the extremes. The next post continues our investigation by introducing a graph showing the likelihood of selected 20-year stock market returns; this will help us to better understand the impact this variability has on retirement planning.

Related Posts

A Retirement Planning Calculator/SpreadsheetRange of Stock Market Dollar Returns for: 10-100 Years, 1-10 Years.

Stock Market 20-Year Returns -- a graph showing the likelihood of various returns.

Range of Stock Market (percentage) Returns for 1-100 Years

What Percent of Your Salary Should you Save for Retirement?

How Much Money Will You Need to Retire?

For lists of additional posts, see the sidebar to the left.

Share This Article

Bookmark this on Delicious

See the "Share" option in the Menu Bar at the top of the page to share via Facebook, Twitter, etc.

This work is licensed under a Creative Commons Attribution 3.0 unported license.

Last modified: 3/31/2010

No comments:

Post a Comment

No spam, please! Comment spam will not be published. See comment guidelines here.

Sorry, but I can no longer accept anonymous comments. They're 99% spam.