(Last updated Sept 2020)

In this post, we graph total stock market returns by year -- going all the way back to 1929. Total return includes dividend income as well as capital appreciation; the previous post in the stock market performance history series considered only closing prices/ capital appreciation. (Note: if you are especially interested in 1929-32, see The 1929 Crash.)

Dow Index Annual Performance Graph: 1929 - 2019

|

| Dow Yearly Total Return 1929 - 2019 |

The bar chart above (click on image to enlarge it) shows the DJIA (Dow Jones Industrial Average) total yearly return for close to 100 years. (To see a stacked bar chart showing the contribution that earnings growth, dividends, etc. made, by year, see The Extraordinary Impact of P/E Ratios.) A regular line graph gives you little sense of the year-to-year performance; I think the bar/column chart works much better. What can we learn from this graph? Initially, about all I could conclude from this extensive performance history was:

- Stock market returns vary a lot from year to year

- The market goes up a lot more often than it goes down, but you can sometimes lose money

- The down years are often isolated, "one-off" events, and usually smaller than the up years -- kinda like speed bumps

- While most down years seem to result in "minimal" losses, a few resulted in substantial losses of more than 20%

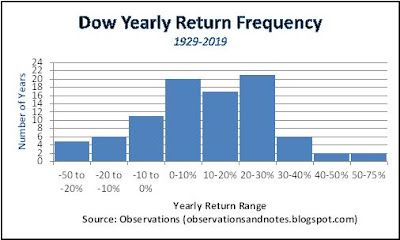

Dow Yearly Return Frequency Chart

(histograms are through 2019) |

| Dow Yearly Return Frequency |

In the histogram above (click to enlarge), the label below each bar is the range of returns represented by that bar. For example, we see that at the low end there were 5 years with losses between 50% and 20%, and, on the far right, two years with gains between 50 and 75%. There were no years with returns below -50% or above +75%. For me, the histogram provides a more useful view of this data; the variability from year to year is still pretty mind-boggling. However, now I can see that:

- Stock market returns are negative about 22 (or about 25%) of the years; so, about 75% of the years have positive returns. And, the positive returns are sometimes very positive indeed.

- About two thirds of the time (58 years), the returns have been between 0% and 30%

What's not to like? It looks like when you lose, you lose a little, but when you win you can win a lot!

In addition, you could make the argument that investing is not a one year deal, so it makes more sense to look at performance history over the longer term. Here's the same histogram as above, but with 10-year returns instead of yearly returns.

Dow 10-Year Annualized Return Frequency Chart

Dow 10-Year Return Frequency

Note that this is the same data, with the same return ranges along the x-axis (horizontal axis). However, look at how much less variability there is in the rates of return! Also note that, because we are looking at 10 years at a time, there are 10 fewer data points -- 1929-1939, 1930-1940, ... 2009-2019. The apparent message here is that, over 10 year periods:

- Approximately half the time the 10-year return was between 0% & 10% per year

- Approximately half the time was between 10 & 20% per year

- In theory, people have not lost money when buying and holding the Dow index for 10 years or longer. Note, however, that theory ignores the impact of taxes and fees. Still, it's pretty impressive.

Conclusions

Again, what's not to like? Stock market history seems to suggest that worrying about the year-to-year variability (let alone worrying about monthly, weekly, or day-to-day variability) is a fool's errand. You could conclude from looking at the above graphs that investing in the stock market can be a very good thing indeed; I think that's true. You might also conclude that it's virtually impossible to lose money in the stock market over the long term. I'd hold off on that one. You might want to review, for example, the graph of rolling 10-year stock market returns. Equally importantly, take a look at The Variability of 10-Year Stock Market Returns in Dollars to see what impact these apparently small differences in 10-year annualized returns can have on the value of your retirement portfolio.Notes: The above charts are based on DJIA (Dow Jones Industrial Average) data through 2019. Results would be conceptually the same if we used S&P 500 data.

Related Materials

More on the variability of stock market returnsRange of Stock Market Returns from 1-100 Years: graph of best & worst past returns for 1, 2, 3, ... 100 year periods.

25 Best & Worst Yearly Stock Market Returns: a closer look at 1-year returns

Range of Stock Market Returns in DOLLARS: A critical, and surprising, perspective.

Rolling 10-Year Stock Market Returns: all 10-year returns, not just best & worst.

Variability of 10-Year Stock Market Returns, in Dollars: a closer look at variability of returns over 10-year periods.

And the causes of that variability

The Extraordinary Impact of P/E Ratios the contribution to yearly return made by earnings, dividends and change in p/e.

P/E Ratio Impact on Future Returns: Returns of purchases made when p/e is high compared to returns of low p/e purchases, in dollars.

Initial P/E Ratio vs. 10-Year Returns: Shows the 10-year returns that resulted from purchases at each initial P/E ratio; demonstrates importance of P/E at time of purchase.

Additional long-term investment performance history

Dow 100 year stock market history chart: Graph of Dow index performance since around 1900.

100 Years of Treasury Bond Interest Rate History

Stock Market Average Annual Return Since 19xx: Investor returns for the most recent 5, 10, 20, etc. years.

Copyright © 2020. Last modified: 9/4/2020

Share This Article

To share via Facebook, Twitter, Pinterest, etc., see below except on mobile devices (where you share in the normal way).Archives

Very interesting views of the data. I think the long term view is best, but it must be balanced against needs for funds as you approach retirement. As people approach retirement, they need to get more and more conservative in their investments. This is part of the issue today since there are so many baby boomers now entering the retirement phase of their life. But one thing I have learned the hard way is if you get caught in a down market, it is best to just ride it out. These data support that view. However, bear in mind that today's economy is far different than it has been in the past. We have very little manufacturing base in the USA anymore. As the standard warning reads "Past performance is no guarantee of future results."

ReplyDeleteAnon,

ReplyDeleteThanks for the comment.

I agree that for most people it is appropriate to invest more conservatively as you approach and enter retirement. I'll have more to say about that later when I start posting about the implications of some of these results on retirement planning.

I also probably agree with your thoughts on riding it out -- IF you have a well constructed retirement plan, and your asset allocation has been thoroughly thought through, and both are appropriate given your age, risk tolerance, financial resources, etc. However, I would shy away from making a blanket statement that it's the right strategy for ALL people in ALL down markets. I think it depends on one's circumstances. That's one reason I virtually never make recommendations in my blog.

OK, interesting study, but did you consider that 30% of your population is retiring in the next 10 years?? If 30% of your population is going conservative and the other 70% are struggling to make ends meet, who will replace the growth of the baby boomer's from 1980 to 1998 market growth? Is it our 1.5 children?

ReplyDeleteWhat is the overall average since 1929?

ReplyDeleteSee the Average Annual Return Since 19xx post. That post tracks return through the end of the most recent end-of-year.

ReplyDeleteWhat does each month look like over the years what does the market look like on average in september,

ReplyDeletewhat doest the market look like on average in september during a down year.

Interesting questions. Unfortunately, my primary data is yearly data, so I haven't looked at long-term performance on a monthly basis.

ReplyDeleteOverall, your work is fascinating. This is my frist time to the site.

ReplyDeleteHave you posted interest rate along with stock for the past 100 years? Also, do you have most updated NPE? I think your current post has up to 2008. How is the current NPE comparing to history.

Unk,

DeleteIf you look in the sidebar list of most popular posts all-time, you will see both a 100-year stock market chart and a 100-year interest rate chart. However, if the question is whether I have a chart that combines both, I do not (though, you could easily construct one from the two spreadsheets if you like). I have thought about doing that, but so far have not.

Remember, the nature of my normalized p/e is such that it cannot be calculated until several years after the fact (see About P/E and Normalized P/E). Given that, I suspect what you're seeing is the latest available; if not, let me know which post or spreadsheet you're looking at and I'll try to update.

Thanks for stopping by.