(Last updated November, 2020)

The declining value of the dollar is one of the biggest threats to retirees, and near retirees. This post explores the history of that decline over the past 100 years or so, with graphs going back to 1900.One of the biggest threats to my own retirement plan is the cumulative impact that future inflation rates will have. Readers whose retirement income is not cost-of-living-adjusted need to evaluate the impact that inflation and the declining value of the dollar will have on their income, and be prepared to supplement their income as necessary.

Try my interactive inflation calculator that will convert any prior year dollars to any later year right on your screen. Then come back to this post and look at the bigger picture.

Decreasing Purchasing Power of the U.S. Dollar: What's $10,000 in 1900 Worth Today?

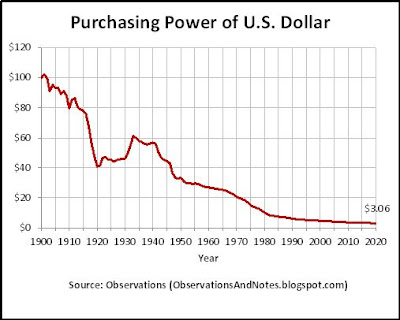

The graph above (click to expand) shows that if a shopper were magically transported from the year 1900 to 2020, the $100 bill that he had in his wallet in 1900 would now be worth only $3.06! That is, $100 in 2020 would have the purchasing power that $3.06 had in 1900; $10,000 would be worth only $306 today. That's a 96.9% decrease in buying power. Our shopper would consider current dollars virtually worthless. (Note: the calculations in the post were made using my inflation calculator.)

The Cumulative Impact of Inflation on Retirement Planning

Since 1900, U.S inflation has averaged about 3.0% per year. However, even at that moderate rate, the cumulative effect isremarkable. The implications on retirees should be clear; even moderate rates of inflation have a large impact over long periods. For example, if inflation averages 3%/year, in 20 years (e.g., between age 65 and 85) the value of a $100 bill will be almost cut in half -- it will lose about 45% of its value. (See What Will $100 be Worth in 10-20 Years?)

If you live in retirement for more than 20 years, or inflation rates are higher than average, the impact is even more dramatic. During my mother's retirement, the dollar lost over 70% of its value. Her retirement lasted almost 30 years, and included the high-inflation 1970's and early 1980's. It's possible that you could have a similar experience -- especially if you're female.

Consider Inflation & the Future Value of the Dollar in Your Retirement Planning

One of the biggest threats to my own retirement plan is the cumulative impact that future inflation rates will have. Readers whose retirement income is not COLA (cost-of-living-adjusted) income need to evaluate the impact that inflation and the declining value of a dollar will have on their income, and be prepared to supplement as necessary.Frankly, I'm even concerned about Social Security and other pensions/annuities that do have COLAs. Promised pensions can be paid only if there is enough money available to pay them. In addition, COLA increases in some plans may not keep pace with the actual increases in your yearly expenses. For example, some increases are based upon the increase in so-called "core" inflation. Core inflation does not include food and energy; my inflation does....

100-Year History of Decline in Value of a Dollar -- Log Version

Here's another graph of the exact same data (click to expand), but I've changed the scale on the vertical axis from the "normal" (linear) way you'd see it to logarithmic. As I discuss in about log graphs, when you're graphing data over decades, or when there are large changes in values, using a log scale for the vertical axis presents a more accurate picture. These two graphs highlight the difference.

The Advantage of Using a Log-Scale Axis

In the top chart, the drop in purchasing power between 1915 and 1920 dominates the chart -- it was a drop of almost $40. The inflation of the 1970's, on the other hand, appears relatively benign -- the value of a dollar decreased by less than $10. But note that in the teens you were starting from of base of around $80; in the 70's, you were starting from a base of around $20.In the second chart, however, those two drops are about the same magnitude because they're both about 50% drops. The distance (on the vertical scale) between the start and end of each period is about the same; the drop in the 70's is just not quite as sharp -- it's over an 8-year period rather than a 5-year period. I think this is a more meaningful representation of what we're trying to measure.

Just to beat a dead horse, consider this. If, God forbid, inflation had been 100% in 2011, purchasing power would have been reduced from about $3.60 in 2011 to $1.80 in 2012 -- a drop of $1.80. On the first chart, since it measures changes in terms of dollars, you would hardly notice $1.80. On the other hand, in the second chart you would see a drop of about the same magnitude as the drop in the teens, but this time over a shorter period of time. That's a lot more representative of what we experience in the real world -- and why my long-term stock market price graphs all use a log scale for the vertical axis. (For more on this, see About Log Graphs).

Related Posts

What Would $10,000 in 19xx be Equivalent to Today? an easy way to convert dollar amounts in the past to the approximate equivalent amount this year.How Much Will $100 be Worth in 10-20 Years? converts current dollars to equivalent value 1-50 years in the future assuming inflation rates from 1-10%.

100 Years of Inflation Rate History Graph of yearly inflation rates, and discussion of the impact.

The Observations Inflation Calculator: will calculate inflation and the change in purchasing power between any two years in the past -- e.g., between 1970 and 1980. The source for the above graphs.

To see the historical impact of inflation on investments, see:

100 Years of Inflation-Adjusted Stock Market History, 10-Year Treasury Note Inflation-Adjusted Return History, 100 Years of Inflation-Adjusted Housing Prices.

For lists of other posts, by category, see the drop down list (mobile viewers) or tabs (computer viewers) just below the blog header at the top of the page. There are additional links in the sidebar if your device supports sidebars.

Data Sources

Robert Shiller "Irrational Exuberance" data

Copyright © 2011. Last modified: 11/21/2020

I couldn't agree with you more. I'm worried about the future state of the dollar. You might enjoy watching a related video on the subject of hyperinflation and the national debt that was just released called "Route Causes." Route Causes, follows the animated adventures of a traveling news crew, providing comedic perspective on current events. We're trying to build an audience for it. If you like it, please feel free to pass it on. http://www.routecauses.com/

ReplyDeleteThank you sir. Glad you enjoyed it. Don't be a stranger.

ReplyDeleteI have kept receipts for food purchases over the past 5 years.

ReplyDeleteMany items went up in cost by 40% to 60%.

The Dow is maybe at 14,000, about 40% of it, in increased numbers is the loss of the buying power of the dollar.

When you add the deficit of over 16 Trillion dollars and growing, how much value is the dollar today (maybe 50% less).

The outsourcing of our goods and services is a formula for economic bankruptcy and the loss of the American way of life.

Purchasing power went down, also due to unemployment and lower wages.