Real, Inflation-Adjusted, Housing Prices Since 1900

|

| Inflation-Adjusted U.S. Home Prices Since 1900 |

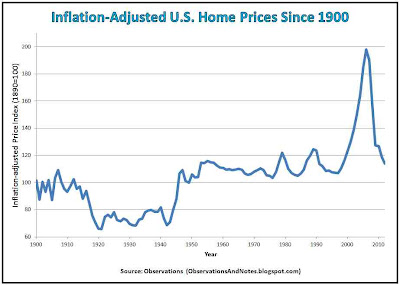

Above is a graph (click to enlarge) reflecting inflation-adjusted prices for residential housing in the United States since 1900. The graph is based on Robert Shiller's housing price index, which I have summarized to yearly data. His index attempts to

estimate the change in price over time for a home of constant size and quality, when expressed in constant dollars. For example, suppose a particular two-bedroom, two bath home sold for $198,000 in 2006 (when the chart peaks at 198.0), measured in 2006 dollars. We can then estimate that, priced in 2006 dollars, an equivalent home would have sold for $101,600 in 1900, and $68,500 in 1942 (when the index was at 101.6 and 68.5 respectively).

For the most part, the graph seems to wander along trendlessly - with a few significant exceptions: The sharp drop that began in 1916; the sharp rise that began in 1942; and the sharp rise and fall that began in 1996/1997. {And, now, as I update in November of 2020 we see a sharp rise starting from the 2012 bottom.}

Housing Prices During the Post World War I Era

The sharp decline in real prices after the 1916 peak was at least partially the result of World War I, and the Spanish Flu Pandemic.World War I lasted from 1914-1918. Over 100,000 Americans died in the war, and over 200,000 more were wounded.

The Spanish Flu struck in 1918. Estimates are that 550 million people (close to 1/3 of the world's population at the time!) caught this disease. Somewhere between 50 and 100 million died (3-6% of the world's population). In the U.S., about 28% of the population caught the flu, and 500,000 to 675,000 died.

In both cases, casualties were disproportionally high among young adults -- the age group from which most new families and new homeowners come. The two events together likely put a significant crimp in new family formation for years, reducing demand for houses, and putting downward pressure on prices.

The Advent of Mass Production

Maybe equally importantly, mass production techniques were starting to deliver more efficient processes, and lower prices. One of the first mass produced items was the Ford Model T, introduced in 1908. Ford further improved efficiency and lowered costs by introducing the assembly line in 1913. Similar productivity and cost improvements occurred in the housing industry.Housing Prices During World War II

Germany invaded Poland in the fall of 1939, and we entered the war in December of 1941. Housing prices started increasing the following year --probably in response to severe war-time shortages. During the war, many items were rationed, including meat, cheese, butter, gasoline, coffee, sugar, silk, nylon, and many other items. Some items were not available at all -- e.g., new cars & new appliances.Housing Prices After World War II

By the time the war ended in 1945, there was huge pent-up demand for virtually everything -- not only because of the war, but also because of the years and years of hard times that preceded it (i.e., the Great Depression). Perhaps the largest pent-up demand was for babies! The ensuing baby boom was a primary cause of the increased demand for housing.The G.I. Bill was another major contributor to increased demand for housing. The bill provided government guaranteed low interest, no down payment loans. The impact of the pent-up demand and the millions of returning soldiers buying homes under the G.I. Bill resulted in the largest increase in home ownership rates in our country's history, and put upward pressure on prices. This more than offset the decrease in demand resulting from the loss of more than 400,000 American soldiers in the war (vs. about 100,000 in WWI).

The Great U.S. Housing Bubble

There is no clearly acknowledged single cause for the dramatic increase in housing prices that started in 1996/97. The most obvious and immediate causes were historically low interest rates, the growth of risky new mortgage products (such as ARMs), incredibly lax lending standards, and the new ability to securitize/bundle the resulting risky mortgages into packages that obscured the risk.Many argue that those were, in turn, the unintended consequences of the deregulation of the banking industry that started in the 1980s, and new laws, policies and practices designed to encourage homeownership (such as the Community Reinvestment Act of 1977).

Housing prices finally peaked in 2006, the victim of unsustainable prices and rising interest rates. Rising interest rates increased monthly payments on many adjustable rate mortgages beyond the (primarily subprime) borrowers' ability to pay. Falling home prices reduced the market value of those homes below the remaining mortgage balance, and thus made it impossible to refinance those mortgages at lower fixed rates. The result was a rash of home foreclosures, the failure of many mortgage lenders, and dramatic write-downs in the value of many mortgage-backed securities. This so-called "subprime" mortgage crisis ultimately snowballed into the worst financial crisis in America since the Great Depression.

100-Year Inflation-Adjusted Housing Price Growth was Less Than 1%/Year

So, what's the result of over 100 years of ups and downs in the housing market? The bottom line, somewhat surprisingly, is that the average annual price increase for U.S. homes from 1900 to 2012 was only 0.1%/year after inflation! And, that includes the possibly one-of-a-kind increase in prices caused by the baby boom and G.I. Bill. [Nov '12 note: As I suspected would happen when I originally posted, home prices are now back down in the 100-120 range. That's usually what happens with bubbles....]Note: This doesn't necessarily mean that residential real estate is a lousy investment; it is, after all, keeping up with inflation. It does, though, remind us that housing is more complicated to analyze than you might expect. We'll continue the analysis in a later post.

November 2020 Update

I must admit, I have not been following the housing market very closely during my non-blogging hiatus, so I was surprised to see an uptick that looks unnervingly reminiscent of the froth that preceded the great housing crash around 2008 - one of the two largest drops in housing prices in our history. Add to this the fact that we are now in the middle of a major flu pandemic, and the last comparable pandemic caused the other largest drop in housing prices in our history, and there is, at minimum, reason for caution.

On the positive side, the Fed has lowered interest rates to near zero and seems prepared to keep them there indefinitely making homes more affordable (because of lower mortgage rates) and maybe igniting a little inflation, causing/supporting even more appreciation in housing prices. Inflation also benefits homeowners who have mortgages by allowing them to pay off their debts in inflated, cheaper dollars. On the other hand, when interest rates rise, as they must eventually, that will put downward pressure on housing prices.

Obviously, no one knows what the future holds, or exactly how these countervailing forces will balance out. Equally clearly, some caution is indicated. Unless you're thinking about refinancing your current mortgage (and not taking any money out); in which case, what are you waiting for?!

Here is some commentary on the 2020 housing market from Robert Shiller: Robert Shiller warns that urban home prices could decline: July, 2020 interview. How to Navigate the Coronavirus Real Estate Market

Related Posts

100 Years of U.S. Inflation History: includes an overview of the impact of inflation on housing.

Housing vs Stock Market Growth Revisited: provides a fairer comparison

Data Sources

Robert Shiller "Irrational Exuberance" Housing Data: Shiller's inflation-adjusted housing price index data summarized to yearly data beginning in 1900.

History of the United States (1918-1945): especially re WWII and rationing.

World War I casualties

Spanish Flu: more on the 1918 flu pandemic.

Henry Ford: re Henry Ford and the Ford Motor Company

World War II casualties

G.I. Bill: more on the Servicemen's Readjustment Act of 1944, & loans to buy homes.

A Century of Home Ownership Rates 1900 to 2008

Causes of the United States housing bubble: nice, thorough job.

Subprime mortgage crisis another good analysis.

For lists of other posts, by category, see the drop down list (mobile viewers) or tabs (computer viewers) just below the blog header at the top of the page. There are additional links in the sidebar if your device supports sidebars.

Copyright © 2011. Last modified: 11/6/2020

Share This Article

To share via Facebook, Twitter, Pinterest, etc., see below except on mobile devices (where you share in the normal way).

Fascinating post. I was trying to rely on hypothesis, and made several seemingly incorrect assumptions about history – but came to the same basic conclusion about the future. My hypothesis is that a house you buy can get more attractive or less attractive relative to the average, but that the average house price is dictated by affordability. So, average mortgage payments would be a function of GDP per household, and may have changed over the years due to changing priorities, or changing competition for family budget. One observation I was expecting to see is that in periods of high inflation, and correspondingly high interest, real housing prices would have to decline in order that the first few years be affordable – or perhaps there would have been a huge reliance on saving up and ‘starter homes’. Over the time period, I would have expected to see massive increases in GDP per household. In 1900 single income households were the norm. Now, dual income households are likely the norm with two adults.

ReplyDeleteOn housing as an investment though: Are you looking at the average market value of sales, of housing stock in a given year, or are able to somehow track year over year what would happen to dollars invested in the housing market? I will accept that on a long-term basis, market value of sales is a good proxy for market value of housing stock. It would seem however that there are several factors causing the average home on the market or in the housing stock to get more desirable or less desirable over time such that a home bought, held, and maintained to equal condition wouldn’t see its value moving in lock step with the market average.

Anon,

ReplyDeleteFor some additional analysis, especially re factors that tend to slow housing price growth, see Comparing Housing and Stock Market Growth. I think some of my points there are similar to yours. However, remember Shiller's price index attempts to measure the price change for a house of constant size and quality. As a result, for example, the increase in family income as we went from single-earner to multiple-earner households doesn't have the impact you expected.

My comment on housing as an investment was just meant to point out that calculating the return that an individual homeowner would earn from buying a home is more complicated than just taking the performance of the price index.

Thanks for stopping by.

To Anonymous:

ReplyDeleteI appreciate your taking the time to leave a comment a couple of days ago. Unfortunately, I"m not quite sure what your point was, and I don't think readers will read a comment that is longer than the original post! If you want to submit a shorter version that's more to the point, I'll try to respond.

regarding adjusting the housing prices for inflation using cpi-u... seeing that housing is a significant component to cpi, wouldn't this be a type of circular reference? while i do not know the extent to which this circular reference impacts the #s for inflation adjustment, it seems like this would definitely skew numbers, right?

ReplyDeleteor am i missing something?

thanks for the perspective on housing trend in the last 100yrs!

I can see where you would think it might be circular. However, consider if the CPI were based solely on housing. If housing went up 5% from year 1 to year 2, the CPI would go from 100 to 105. To get from housing prices in year 2 to housing prices in year 1, you'd still want to divide by 105.

Delete