A Common Retirement Planning Misunderstanding

Do you believe the longer you invest in the stock market the less risky it is? If so, your retirement plan may be riskier than you realize.

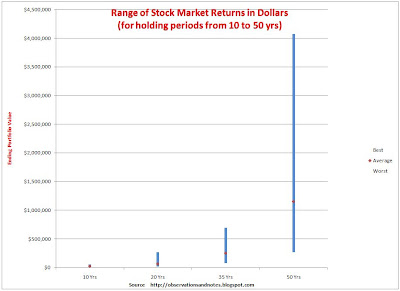

Graphs showing the range of returns over multi-year periods for the stock market as a whole usually look like an arrowhead (like the graph in this post). These graphs are easily misinterpreted. The difference between the best and worst rates of return gets smaller as the number of years increases; readers often assume that the difference between the best and worst outcomes as measured in dollars is also getting smaller. This is NOT the case -- as is clear from the graph below (click to expand).

Range of Returns for the Dow Jones Index (in Dollars, not Percentages)

Viewed in Dollars, Time INCREASES Variability

The graph above is based upon exactly the same data as the graph in the earlier post, and shows the results for the same theoretical investor, starting with an initial investment of $10,000. However, instead of showing the maximum, average and minimum annual percentage return for each holding period, it shows the maximum, average and minimum dollar value of the portfolios at the end of the holding periods. No one