Worse Than Worst-Case Scenario?

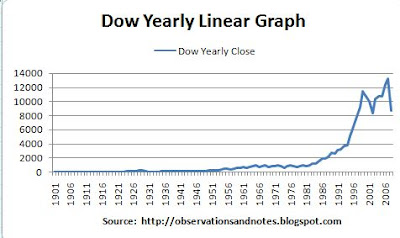

What if we had a repeat of the stock market crash of 1929 -1932? In a previous worst-case post, I developed a worst-case scenario with the DJIA (Dow Jones Industrial Average) closing in the neighborhood of 4100. An alert reader suggests that is optimistic! He maintains that, if we were to repeat the 1929 crash, the Dow would fall to 2100.

Why the difference? The short answer is because my previous worst-case posts used very high-level, year-end data. The point I was trying to make in the earlier posts was that it would be prudent to at least consider the possibility of the Dow at levels that seemed unimaginable at that time. In this post, we will analyze daily data.

The 1929 (Great Depression) Stock Market Crash Graph

As you can see in the chart above (click to enlarge), the Dow peaked in September of 1929 and continued "steadily" downward through 1930 and 1931 until it bottomed in July of 1932; the Great Depression continued for some years afterwards. (Note: To see how this period fits in the bigger picture, see 100 Years of Stock Market History. If you are not familiar with log graphs like this one, see About Stock Market Log Graphs) The bottom line? A $10,000 investment in 1929 was reduced to