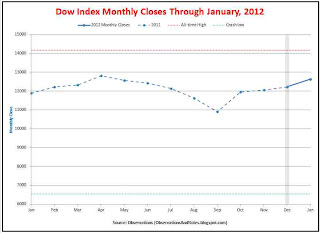

Dow Testing 13,000

In February, the Dow reached not only a new 52-week high but a multi-year high, besting 13,000 for the first time since May 2008. After failing multiple times, the Dow finally closed above 13,000 on February 28th, but couldn't hold on through month-end.The lack of market volatility continued. Again there was not a single +/- 2-3% day, and only once did the Dow move more than 1%. The DJIA (Dow Jones Industrial Average) just quietly continued its apparently inexorable march upward, ending the month