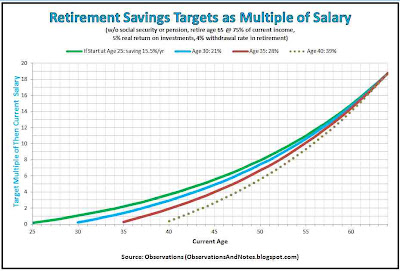

Previous posts established retirement savings benchmarks/targets from age 25 to 65 for a typical average income worker and a typical high-income worker. This post only calculates the target at age 65, and, as a result, is appropriate for all salary levels.

How Much Will You Need to Retire?

|

| How Much Money Will You Need to Retire? |

With an Average Salary, You'll Need Around 9 Times Your Salary to Retire

If you follow the 4% withdrawal guidelines, it's easy to calculate how much money you will need in order to retire at age 65. Basically, you will need (100%/4%=) 25 times the amount you expect to withdraw from your savings in your first year of retirement. To facilitate the computation, I have assumed that your total yearly spending in retirement will equal 75% of your current salary, adjusted for inflation.However,