- March: Powerful Quake and Tsunami Devastate Northern Japan - NYTimes ...

- May: Bin Laden Is Dead, Obama Says - NYTimes.com

- August: United States loses prized AAA credit rating from S&P | Reuters

- Sept: Treasuries twisting, with 10-year yield at record low (CNN)

- Dec: S&P Puts 15 Euro Nations on Watch for Downgrade Amid Sovereign-Debt Crisis (Bloomberg)

Monthly Stock Market Closes for 2011

December, 4th Quarter, Year-To-Date & Recovery-To-Date Review

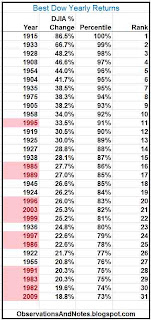

Previous posts have demonstrated that the market periodically experiences "long, flat periods." This certainly seems to be one of those. Perhaps it was in that spirit that the S&P managed to end 2011 0.02 points away from where it ended 2010!The DJIA (Dow Jones Industrial Average) fared somewhat better, closing the year at 12,217.56. Here are some key market stats.

- From Prior Month Close of 12,046: The Dow is up 172 points (1.4%)

- From 3rd Quarter Close of 10,913: Up 1304 points (12.0%)

- From 2010 Close of